The buying and selling of IPv4 address space has become one of the most active parts of today’s digital economy.

Although IPv6 exists to handle the growing number of connected devices, many companies still rely heavily on IPv4 to maintain their infrastructure. Because supply is limited, a secondary market allows organizations to purchase and transfer address blocks.

Understanding how this process works is essential for anyone looking to acquire space or sell unused resources.

The main reason this market exists is scarcity. IPv4 was created decades before billions of devices were connected to the internet.

That original pool has been stretched thin, and while IPv6 offers virtually unlimited capacity, adoption has been slower than expected. Until the transition is complete, IPv4 remains critical.

This demand keeps prices high and encourages trading between companies that have surplus space and those that urgently need to Buy IP Addresses.

All legitimate transfers must go through Regional Internet Registries (RIRs). These organizations — such as ARIN, RIPE NCC, and APNIC — oversee how addresses are allocated and transferred.

They maintain ownership databases, enforce compliance, and ensure global recognition of transactions. Without their approval, a buyer risks ending up with addresses that may not work properly across the internet.

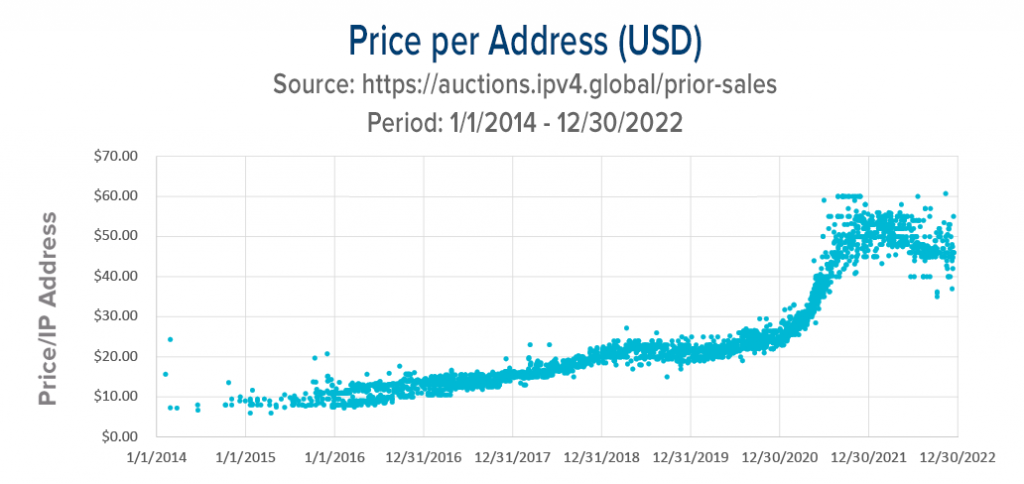

Pricing reflects both scarcity and demand. Smaller blocks typically cost more per address because they are easier for organizations to deploy quickly. Larger blocks are cheaper per unit but require greater upfront investment.

Demand from cloud providers, telecom companies, and businesses expanding digital services can push prices higher. Geography also plays a role, since some regions face stronger demand than others.

One of the most important steps for buyers is checking the reputation of an address block.

Some space may have been linked to spam or malicious activity, which can result in blacklisting by service providers. Clean addresses are far more valuable and easier to use. Due diligence through reputation checks helps avoid costly mistakes.

The transfer process generally includes identifying a block, negotiating terms, and submitting documentation to the registry.

Sellers must prove ownership and ensure the space is no longer in use. Once approved, the registry updates records to reflect the new owner, and the addresses can be routed and used.

Sellers benefit by monetizing unused space. Many companies received large allocations years ago and no longer need them. Selling part of this space generates revenue, but it requires careful preparation.

Addresses must be fully removed from active systems to avoid conflicts, and sellers should be transparent about the history of the blocks being offered.

Both sides must also consider financial and legal obligations. Because IPv4 is considered a digital asset, transactions may trigger tax responsibilities. Buyers often classify purchases as operational expenses, while sellers may face capital gains reporting. Consulting with legal and financial professionals is strongly recommended.

Security is another concern in this market. Because IPv4 blocks carry significant value, fraud is possible. Some actors attempt to sell addresses they do not own or misrepresent block conditions. To reduce risk, many buyers and sellers use escrow services or professional brokers. Reputable intermediaries verify ownership, manage negotiations, and handle registry paperwork. While brokers charge fees, they help protect both sides from costly errors.

Strategic planning is key. Buyers should weigh whether purchasing IPv4 is necessary or if adopting IPv6 is a better long-term option. Some businesses cannot avoid buying IPv4 because of legacy systems, but newer projects may benefit from deploying IPv6 directly. Sellers, meanwhile, must consider whether parting with space today could create challenges in the future, since reacquiring blocks later is often more expensive.

The future of this market depends largely on IPv6 adoption. As more companies transition, reliance on IPv4 will decrease, which could stabilize or lower prices. But until the shift is complete, demand will remain strong. Technology trends such as cloud expansion, mobile growth, and the Internet of Things continue to drive demand for address space, ensuring the market remains active for years to come.

For investors, IPv4 can resemble digital real estate. Scarcity drives value, but long-term risk remains because IPv6 will eventually reduce demand. That makes IPv4 most attractive for short- to mid-term investment strategies rather than indefinite holding.

Critics sometimes argue that trading favors wealthier organizations that can afford higher prices, while smaller groups may struggle to compete.

Others point out that the market ensures unused resources are redistributed where they are needed most. Transparency, fair pricing, and strict adherence to registry policies are essential to maintaining trust.

Preparation is the best way to succeed in this space. Buyers should research registry rules, budget carefully, check address reputations, and consider using brokers. Sellers should clean their networks of any references to blocks they plan to sell and comply with all transfer requirements. Both should factor in tax implications and protect themselves with legal documentation.

The secondary market for IPv4 exists because business continuity cannot wait for universal IPv6 adoption. Buyers gain stability and scalability, sellers unlock revenue from dormant assets, and investors have the opportunity to profit from a scarce resource.

With careful planning, compliance, and risk management, participants can make decisions that serve their organizations while supporting the continued stability of the internet.